Tokenomics of OPEX Token | Operaional Excellence token for the ILSSI Community

Download pdf version here: https://ilssi.org/wp-content/uploads/2025/01/Tokenomics-of-OPEX-Token-v2.pdf

Table of Contents

- Executive Summary

- Token Overview

- Initial Liquidity and Trading

- Core Properties

- Token Distribution

- Token Acquisition Methods

- Vesting Schedule

- Token Utility

- Token Economics

- Security Measures

- Risk Mitigation

- Roadmap

- Conclusion

- Updates and Amendments

-

Executive Summary

Operational Excellence token, OPEX Token, is the utility token used by the ILSSI International Lean Six Sigma Institute Community ecosystem and can also be used by any business or organisation for making lean and efficient transfers of value. It is designed to incentivize community participation, reward content creation, and facilitate payments for products and services.

-

Token Overview

– Token Name: OPEX Token (ILSSI Community Token)

– Token Symbol: OPEX

– Blockchain: Polygon

– Token Standard: ERC-20

– Total Supply: 10,000,000 OPEX

– Initial Token Price: US$ 0.01

– Trading Platform: QuickSwap decentralized exchange (https://quickswap.exchange/)

– Decimal Places: 18

-

Initial Liquidity and Trading

– Initial DEX: QuickSwap (optimized for ERC20 tokens on Polygon blockchain)

– Initial Liquidity Pool: 500,000 OPEX tokens (5% of total supply)

– Liquidity Matching: US$ 5,000 worth of POL tokens

– Benefits: Near-zero gas fees and fast transaction speeds on Polygon network

– Initial Token Valuation: US$ 0.01 per OPEX

-

Core Properties

– Mint Authority: None (renounced after initial minting)

– Freeze Authority: None

– Supply Type: Fixed, non-mintable

– Transferability: Freely transferable

– Upgradeability: Non-upgradeable

-

Token Distribution

- Initial Token Allocation

– Development and Maintenance: 30% (3,000,000 OPEX)

– Treasury/Ecosystem Growth: 25% (2,500,000 OPEX)

– Core Development Team: 25% (2,500,000 OPEX)

– Marketing: 10% (1,000,000 OPEX)

– Initial Liquidity Pool: 5% (500,000 OPEX)

– Airdrop to ILSSI Partners, Directors and Shareholders: 5% (500,000 OPEX)

-

Token Acquisition Methods

- Community Contributions

Participants can earn OPEX tokens through active involvement in the ILSSI community:

- Publishing insightful articles and case studies

- Creating educational content

- Organizing and hosting networking events

- Mentoring fellow practitioners

- Developing training materials

- Contributing to research projects

- Referrals or contributing to acquiring new partners or members

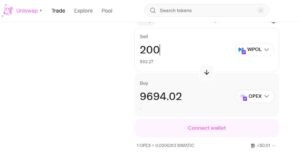

- Exchange Purchase Process

OPEX tokens will be available for purchase on Uniswap:

- Access Uniswap decentralized exchange https://app.uniswap.org/

- Connect your ERC20-compatible wallet (supported wallets include Metamask, Coinbase Wallet, Fantom)

- Purchase POL tokens (Polygon native token)

- Trade POL for OPEX

- Store securely in your ERC20-compatible wallet

You either earn tokens as rewards for activities that contribute and build the community, or you can buy tokens on the Uniswap decentralised exchange at the WPOL/OPEX Pool.

https://app.uniswap.org/explore/pools/polygon/0x2E8aE39814879eacb2b3C72648f28563b624aa19

Use the Swap Tokens feature and swap WPOL ( Wrapped Polygon tokens ) for OPEX Tokens :

OPEX tokens Contract Address: 0xFe5eD36D6EF669D91d26036109121bdc3eeDeC80

-

Vesting Schedule

- Core Development Team (25%)

– 12-month cliff

– 24-month linear vesting after cliff

– Monthly unlock schedule

– Smart contract controlled vesting

- Development and Maintenance (30%)

– 6-month cliff

– 18-month linear vesting after cliff

– Quarterly unlock schedule

- Treasury/Ecosystem Growth (25%)

– Controlled by DAO governance

– 5-year gradual unlock schedule

– Quarterly proposals for fund allocation

- Marketing (10%)

– 3-month cliff

– 12-month linear vesting

– Monthly unlock schedule

- Airdrop (5%)

– 100% unlocked at distribution

– One-time distribution to eligible participants

8. Token Utility

- Governance utility

– Proposal creation and voting

– Treasury fund allocation

– Protocol parameter adjustments

– Community initiative funding

- Platform Benefits

– Access to premium content

– Reduced platform fees

– Priority access to new features

– Exclusive educational resources

– Community events participation

-

Token Economics

- Supply Dynamics

– Fixed maximum supply of 10,000,000 OPEX

– Non-mintable design

– Supply adjustment through governance only

– No inflation mechanisms

- Value Accrual Mechanisms

– Platform fee sharing

– Content monetization

– Certification revenue distribution

– Partnership revenue allocation

-

Security Measures

- Smart Contract Security

– Multiple independent audits

– Time-locked contracts

– Multi-signature requirements

– Emergency pause functionality

- Treasury Management

– Multi-signature wallet implementation

– Diversified asset management

– Regular financial reports

– Professional custody solutions

-

Risk Mitigation

- Market Protection

– Initial liquidity bootstrapping with 500,000 OPEX

– Market making partnerships

– Price stability mechanisms

– Flash loan attack prevention

- Compliance

– Legal framework compliance

– Regulatory considerations

– KYC/AML implementation

– Geographic restrictions

-

Roadmap

Phase 1: Launch (Q1 2025)

– Token Generation Event

– Initial Uniswap listing

– Liquidity pool establishment

– Airdrop distribution

– Governance framework implementation

Phase 2: Growth (Q2-Q3 2025)

– Enhanced utility features

– Partnership expansion

– Community program scaling

– Secondary market development

Phase 3: Maturity (Q4 2025 onwards)

– Full DAO transition

– Advanced governance features

– Ecosystem expansion

– Cross-chain implementation

-

Conclusion

The OPEX Token is designed to create a sustainable and valuable ecosystem for the ILSSI Community. Through carefully planned tokenomics, governance structures, and utility features, the token aims to align the interests of all stakeholders while promoting the growth and development of the platform.

-

Updates and Amendments

This document may be updated through community governance proposals. All updates will be publicly announced and documented through the appropriate governance channels.

Last Updated: 1st January 2025

Version: 2

![UCOURSE.ORG [UCOURSE Academy] was established in Hong Kong in 2019 (company name: UCOURSE LTD), dedicated to providing high-quality online courses and courses for Chinese people in China, Hong Kong, and even all over the world. UCOURSE.ORG 【优思学院】于2019年成立于香港(公司名称:优思学院有限公司 / UCOURSE LTD),致力于为中国、香港、以至身处于全球各地的中国人提供优质的线上课程和考试认证,促进全国的人材培育、个人的职业发展,让学员在事业上事半功倍,同时助力国家的未来的急促发展。](https://ilssi.org/wp-content/uploads/2021/02/ucourse-logo-250.png)